Budget reaction: the quiet triumph of the data centre lobby

In amongst the giveaways, was a opening for the Apple Tax windfall to be siphoned into state subsidies for data centres.

In amongst the bumper giveaways, there is an important note in the budget that could have a major impact on Ireland's economic future: an opening for the Apple Tax windfall to be siphoned into state subsidies for data centres.

IBEC, whose president also happens to be head of Meta Ireland, and that has proven to be an effective lobby for global tech companies in Ireland, has been making not very thinly veiled threats for several months that the state needs to be more hospitable to data centres.

Data infrastructure is key to making the promise of AI a reality, while being extremely water and energy intensive. Speaking to the Business Post last month, IBEC's Director of Lobbying and Influence Fergal O’Brien was quite plain that when the group says that Ireland needs to invest in "infrastructure", it means water and energy to power data processing:

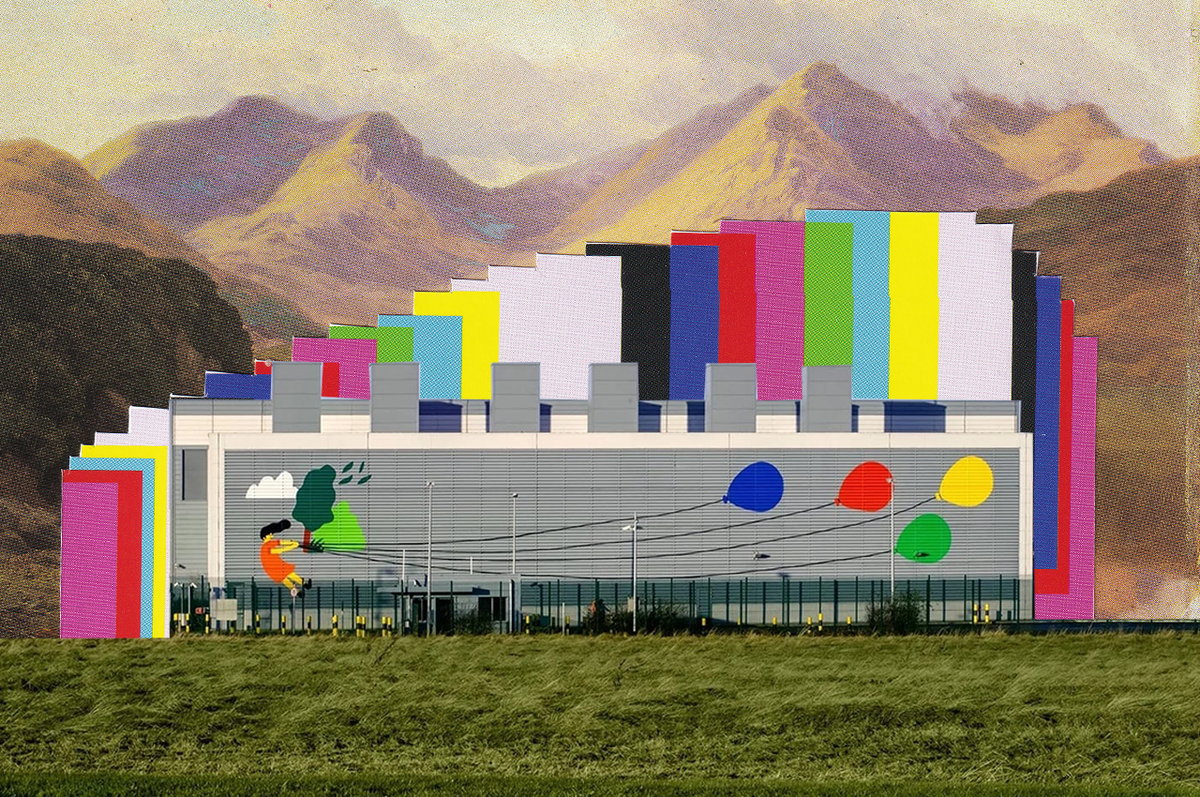

"The reality is tax is not the competitiveness calling card that we had in the past. So all of these things – like world-class infrastructure, clean, competitive energy, plentiful water supply – these are an absolute necessity."

Failure to do this, IBEC outline, could mean losing the kind of investment that the state relies on. He laid out his demand quite plainly; big state cheques:

"We can’t paper over those with a tax offering in the future. So we’re just simply not going to win those projects, particularly in the context where European and other countries are writing bigger cheques to attract industry. If we want to succeed, we’ve got to do this so much better than we have been over the last decade or so."

And lo and behold, we have an indication of where the apple tax windfall is going to go (see previous newsletter). Jennifer Bray reports in The Irish Times:

"So how will the €14bn Apple Tax cash be spent? .... Four pillars have been identified for investment, and they all focus on expanding Irish infrastructure. The four pillars are water, electricity, transport and housing. A “framework” is being developed as to the specifics or where the money goes. There may not be an announcement on this until early next year."

One to watch.