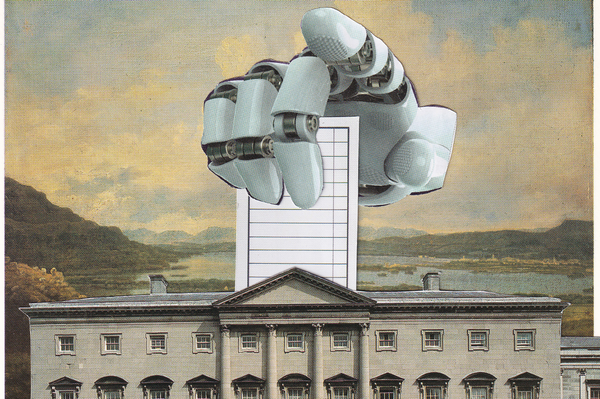

Tech looms over this election, but as fiscal policy, not a campaign tool

Between Trump's appointees, mobile tech capital and changing tax rules, we are facing a possible fiscal cliff. Yet we are still hearing 2007-style auction politics. Where is the vision for a less FDI dependent economy?

I write about technology and politics, and we're at that part of the cycle where journalists from outside of Ireland call wanting to know the tech story of this election.

I find myself telling them the tech story is not one of campaign tactics or digital disruption, but one of fiscal policy. We have a highly lucrative but deeply unsustainable dependency on mobile tech capital, and the new Trump administration might be about to bring that to a head.

So where is the vision of an alternative?

We are banking on the unbankable

The Irish Fiscal Advisory Council, our budgetary watchdog, has been warning us for years. In their recent reaction to the budget they warn that Ireland is benefiting from “excess corporate tax”, which is tax receipts “above what would be explained by domestic economic activity”. In other words, tax that does not relate to the work people are doing in the Irish economy.

For the recent budget’s planned expenditure, the State is using forecasts that presume a continuation of these corporate tax receipts - if they hold, IFAC advise, between now and 2030 we will have a very healthy €80billion surplus.

But if they don’t, that does a complete and economy-shattering 180 - we would have a €50billion deficit.

That is before any new election promises being made to cut taxes, and increase expenditure are factored in.

And entrenching a dependency on tech

We are more dependent on corporate tax revenue than the OECD average, and a disproportionate amount of that tax revenue comes from tech companies; a 2021 analysis of tax records by the Irish Times found that the 3 biggest corporate tax payers were Apple, Microsoft and Google. And another 2023 report by IFAC showed the concentration of ICT firms in the top ten groups of tax payers.

Global changes only starting to kick in

The bumper bonanza is down, at least in part, to two structural changes in the international tax system that likely boost Ireland revenue in the short term, while markets adjusts.

The “Double Irish” - where we as a State facilitated the offshoring of about a trillion dollars (yes, with a “t”) of cash, enabling the vast corporate wealth we now live with - came to an end in the mid 2010s. But, big players like the tech giants were allowed to continue with it until 2020, and our corporate tax receipts doubled between 2020 and 2022.

Meanwhile some of the new OECD “Global Minimum Tax Rules”, which have eroded Ireland’s tax advantage, only came into force this year.

It is notable that these structural changes have not yet led to significant drops in corporate revenue, but any country or Government that relies on either the loyalty or whims of tech bros, venture capital and accountants is taking a massive risk with the foundations of our national prosperity, not to mention our health, education and welfare systems.

As I wrote when the Apple tax decision came down, we have an economy that was built by accountants, quite literally - the Finance Ministers who built the FDI business model were either accountants (Bertie Ahern, Charlie McCreavy), lawyers (Brian Cowen, Brian Lenihan), or both (Charles Haughey). But accountancy is not economics.

Bust, or beck-and-call

Our dependency on these receipts leaves us with two scenarios; either the tax receipts shift to balance sheets elsewhere, and we are left with an enormous hole in our finances (check out a possible canary in the coal mine on this with “AirBNB Ireland” reallocating profits elsewhere).

Or, our dependency is exploited by firms who know that they have us over a barrel. There is a very real risk that our economic sovereignty is eroded by our dependency. See comments by IBEC - whose President also heads up Meta Ireland - I wrote about in advance of the budget:

"We can’t paper over those with a tax offering in the future. So we’re just simply not going to win those projects, particularly in the context where European and other countries are writing bigger cheques to attract industry. If we want to succeed, we’ve got to do this so much better than we have been over the last decade or so."

Where is the vision?

It is deeply frustrating that we are heading into an election with all of this looming, and we are still having 2007-style auction politics. That goes for the current Government, and the opposition, with a few exceptions.

Where is the vision for an economy for the next 10-20 years, beyond FDI, or at least less dependent on it?

But.

I can feel the tone shifting in the past 36 hours. Headlines of competing tax cuts are giving way to disquiet about fiscal sustainability.

Trump tremors reach across the Atlantic

This morning’s Business Post is leading with “The multi-billion Trump-sized hole in Fine Gael, Fianna Fáil and Sinn Féin’s manifestos”, and the Irish Times with the fact that the Cabinet got a warning yesterday that the new US administration will not be friendly to Ireland’s US multinational dependent national economic model.

The turning point seems to be the announcement of the nomination of Howard Lutnik as head of the US Commerce Department; RTE pulled out quotes from Lutnik like:

"It's nonsense that Ireland of all places runs a trade surplus at our expense. We don’t make anything here any more – even great American cars are made in Mexico. When we end this nonsense, America will be a truly great country again.”

But there were already rumblings last weekend as Cliff Taylor at the Times pulled out passages from nominated US Trade Tsar Emmet Lighthizer’s book:

“Ireland gets a substantial part of the tax revenue that would normally be due to the US Government, and the pharmaceutical companies employ tens of thousands of Irish workers.” This, he says, is a “transfer of wealth from us to them”.

Perhaps the shift in tone from the US is best encapsulated in Trump’s right hand man Elon Musk, who has a long running beef with the Irish state. It was the subject of my very first newsletter, which was around the time Musk was amplifying McGregor tweets to vote “No/No” in the March referendums.

X is headquartered in Dublin, meaning the Irish state is often the cold face of EU regulation for the company…. He has also been using his platform to push back on Irish domestic law, especially a proposed Hate Speech Bill, vowing to pay the legal fees of Irish citizens who want to challenge it.

So let's build a new vision

The headwinds are against us, and I do hope that we remember what came after 2007. We have healthy finances, at a time when other countries are really struggling. Let's use this position to not just build up buffer funds, but to think about a new and dynamic - and sovereign - national economic model.

Did you know you can support our work?

I have added a "support us" feature - if you would like to contribute to The Briefing's running costs - it is here. Thank you!